Descartes Aljex has partnered with 1099 Pro to provide electronic filing for Aljex customers. This is designed to run at the beginner of the new year and will provide for the previous years reporting. Here’s some information and instructions on how to use the integration.

What Is 1099 Pro?

The Leader in 1042-S, 1095, 1099, FATCA 8966, CRS, & W-2 Software & Services; 1099 Pro provides tax reporting software for businesses via print, e-mail, and electronic filing.

The benefits of Descartes Aljex customers utilizing the new integration include:

- Save money and resources

- Save time and increase productivity

- Increase timeliness and accuracy of filings

- Remain compliant with current tax laws

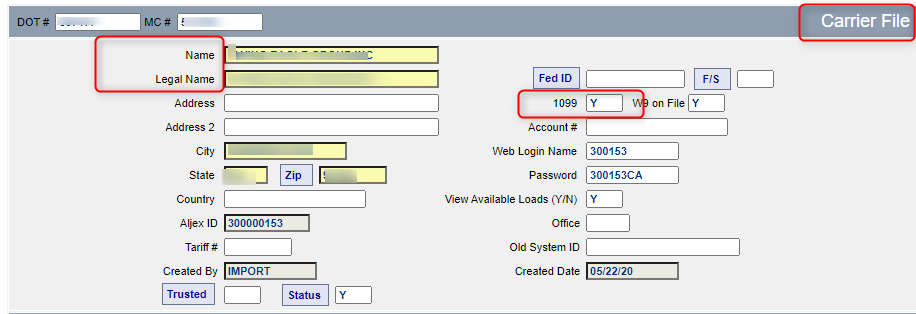

Requirements for selection for 1099 within Descartes Aljex:

- Fed ID or SS # in Vendor File

- YTD $ over $600.00

- Send 1099 = “Y” must be marked Y

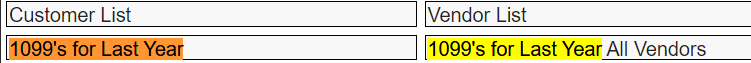

The 1099 reports are in the Customer/Vendor Lists from the Reports tab.

There are 2 options

- 1099’s for Last Year would be vendors who meet requirements 1, 2 and 3 mentioned above

- 1099’s for Last Year All Vendors includes all vendors

On 1099’s the Carrier Name will always print and if there is a Legal Name that will also print. The address used is the Vendor address not the pay to address.

From classic use the ‘Close Year Menu’

- Accounting

- Reports Menu

- Close Year

1099 forms can be sent electronically using 1099pro.com

Important Note: To run 1099, you need to process checks through Aljex

Want More Info?

If you’d like to learn more about the new integration with 1099 Pro, contact support at Descartes. Feel free to provide questions, comments, and product related ideas.

Descartes Aljex is always looking to hear from our customers.